30 October 2025

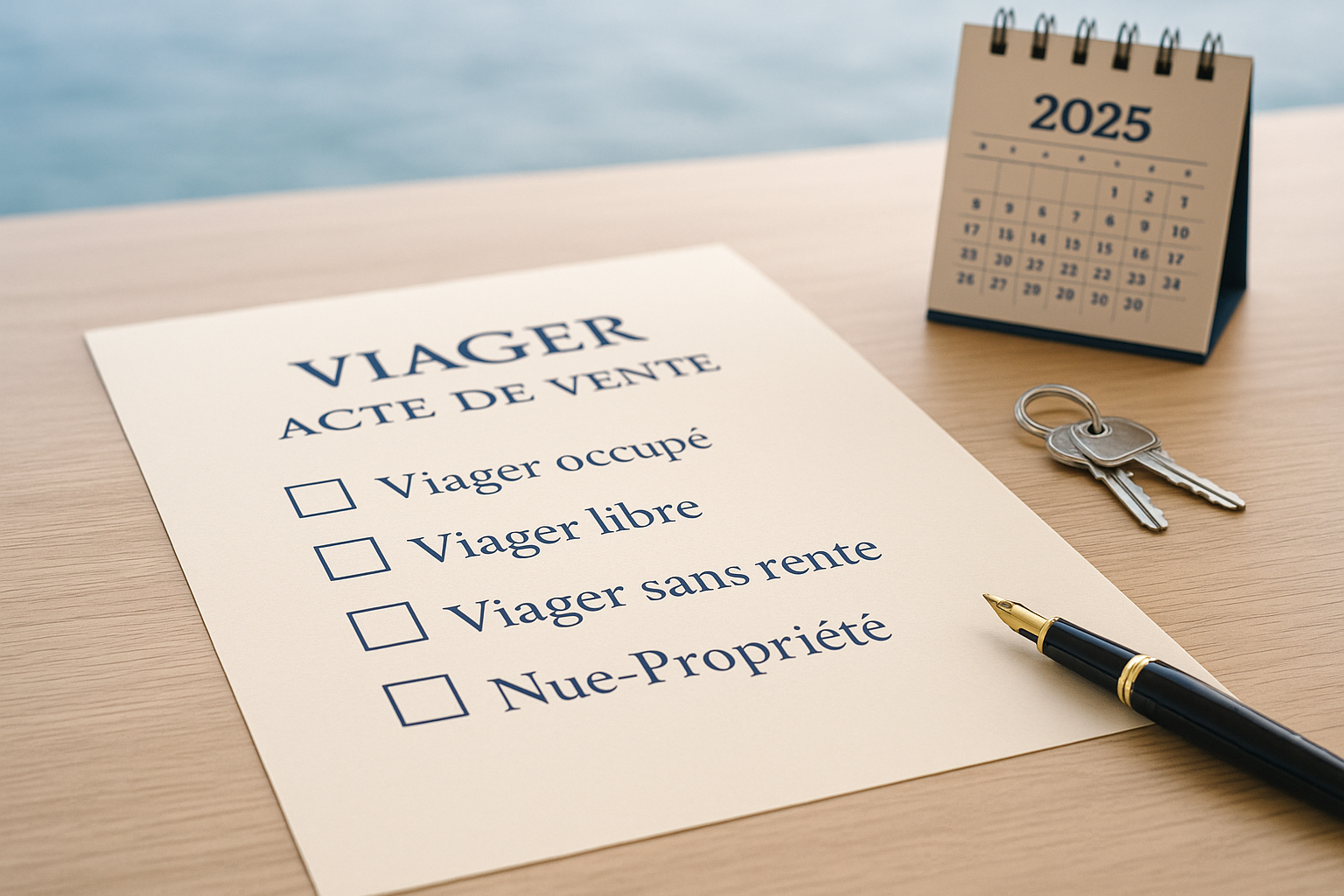

The viager system is one of the most distinctive features of the French property market. It allows seniors to sell their home while often continuing to live in it, receiving either a lump sum, a lifetime annuity, or a combination of both. For buyers, it is an alternative investment strategy, sometimes offering access to prime real estate at lower-than-market prices.

While viager transactions represent only about 1% of property sales in France, interest is growing steadily. Rising life expectancy, lower pensions, and investor appetite for stable real estate assets are fuelling this niche. But not all viager contracts are the same. Understanding the different structures is key before committing to one.

1. Viager Occupé (Occupied Viager)

This is the most common type of viager. The seller (called the crédirentier) sells their property but keeps the right to live in it for life (droit d’usage et d’habitation). The buyer (the débirentier) makes an upfront payment (bouquet) and then pays a monthly or annual annuity until the seller’s death.

• For sellers: They continue living in their home, while receiving a steady income stream. This provides both financial and emotional security.

• For buyers: They purchase at a discounted price, since they will only gain full possession once the seller has passed away.

Risk balance: For the seller, income security is guaranteed as long as the buyer pays. For the buyer, the “bet” lies in life expectancy—if the seller lives much longer than expected, the investment can become costly.

2. Viager Libre (Free Viager)

In this structure, the buyer gains immediate possession of the property. The seller moves out at the time of sale but continues to receive a lifetime annuity.

• For sellers: They no longer occupy the property but receive higher annuity payments compared to viager occupé.

• For buyers: They can rent, renovate, or live in the property right away, making it attractive for investors who want immediate control.

Risk balance: Sellers lose the emotional attachment of living in their home, but gain higher income. Buyers take on the annuity risk but enjoy the benefit of current use.

3. Viager Sans Rente (Lump-Sum Viager)

Here, the buyer pays only a large bouquet at the time of signing. There are no annuity payments. The seller usually retains the right to live in the property for life.

• For sellers: They gain a significant amount of capital immediately, which can be used for projects, healthcare, or to support family. It simplifies administration—no need to track annuity payments.

• For buyers: Easier to finance (banks are more comfortable lending for lump sums), and the transaction is simpler. If the seller passes away earlier than expected, the buyer gains possession of the property sooner, making the overall value of the investment more favourable.

Risk balance: Sellers must carefully budget, as they will not receive ongoing income. Buyers must be prepared for a high upfront payment.

4. Nue-Propriété et Usufruit (Bare Ownership with Usufruct)

This is a form of split ownership. The buyer acquires the nue-propriété (bare ownership), while the seller keeps the usufruit (right to live in and benefit from the property) until death. At that point, full ownership automatically transfers to the buyer.

• For sellers: They keep use of the property and may even rent it out for income.

• For buyers: They acquire ownership at a reduced price because they cannot use the property immediately.

Risk balance: It’s a flexible solution, but the value depends heavily on how long the usufruct lasts.

5. Mixed Forms (Customized Contracts)

Some contracts combine elements—for example, a moderate bouquet, reduced annuity, and partial occupation rights. Contracts can also specify clauses about inheritance, resale rights, or the possibility for early exit.

These hybrid structures are increasingly common, as not all sellers want long-term annuities and not all buyers want high upfront payments.

Benefits for Seniors (Sellers)

• Financial security: regular income or lump sum to supplement pensions.

• Independence: many options allow seniors to stay in their homes.

• Flexibility: structures can be tailored to specific needs.

Benefits for Buyers (Investors)

• Discounted access to real estate: properties can be acquired below market prices.

• Investment diversification: viager acts as a hedge against volatile markets.

• Immediate use (in viager libre): potential for rental yield or personal use.

Risks and Considerations

• For sellers: choosing the wrong structure may leave them without sufficient long-term income. Legal advice is critical.

• For buyers: the “uncertainty of life expectancy” is the biggest variable—annuity payments can stretch far longer than expected.

• For both: it requires trust and clear legal documentation. Disputes, while rare, often arise from misunderstanding obligations.

Alternatives: Reverse Mortgages

For seniors who prefer not to sell through viager, reverse mortgages are an alternative. They allow homeowners to borrow against the value of their property, receiving either a lump sum or regular payments, with repayment made after death from the estate.

Conclusion: A Niche Market with Momentum

Viager sales represent only a small share of the French property market, but they are growing. Rising property values, demographic changes, and financial pressures on seniors all point to continued expansion. For seniors, viager offers a way to unlock value and maintain independence. For investors, it presents a unique route into real estate.

Choosing between viager occupé, viager libre, viager sans rente, or split ownership depends on the financial needs, lifestyle, and risk appetite of each party. With careful structuring and professional guidance, viager transactions can be a win-win solution.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.